By Shani Jayamanne, Senior Investment Specialist, Morningstar

8 March 2024

There are many factors that contribute to successful investing outcomes. Yet it is hard to argue that any are more important than continuing to study and learn from successful investors. If we apply the gender lens to the investing landscape, there are several studies that indicate that women achieve better investing outcomes than men.

Our own data at Morningstar looks at female portfolio managers outperforming the general population of portfolio managers. Other studies have looked at individual investors and found that women achieve better results.

However, both genders offer investing lessons. Men are more likely to invest in the first place. The first step to being successful in any endeavour is to get started.

My own approach to investing incorporates the lessons I’ve learned from both men and women to try and achieve my goals. In order to be successful I’ve focused on setting myself up properly. Structuring my finances correctly means that I have confidence in my financial position and the investments that I hold. This has allowed me to overcome my natural reluctance to put my hard-earned money at risk.

This includes having an emergency fund so I don’t pull down on my investments at inopportune times. It also means that the investments that I make are thoughtful and are connected to my financial goals.

It is only human to want to maximise your wealth and this can often be translated into buying hot stocks or themes to hop on the gravy train. I’ve made this mistake in the past – notably with the ARKK ETF which focuses on companies exhibiting “exponential growth” in the words of portfolio manager Cathie Wood. I purchased the ETF in January 2021. It was only $1,000, but I deviated from my Investment Policy Statement (IPS) because I had an irrational fear of missing out. I can’t guarantee that I won’t do that again, but I am conscious of my decision making around my investments and have set strict parameters through my IPS that will reduce the risk that I do.

I connect my investments to my financial goals. The process I have set up means that I don’t have to think. Overthinking can be problematic if you are naturally risk averse. There are always headlines predicting the next plunge in the market or the next geo-political disaster. I’ve recognised that I will find success with finding the right investments and making regular contributions with every paycheck over the long-term. I have confidence in these investments because they are connected to my goals. I have researched them and been thoughtful and meticulous about my approach, the fees that I’m incurring and the vehicles that I am using to lower transactions costs.

This is how I will achieve success with investing over the long-term. The Morningstar research on female portfolio managers that shows women are more successful at investing does not go into the details of why this is the case. In my case, success is being thoughtful about my investments and ensuring that I do not chase returns. It is about knowing myself and my behaviour and building a strategy around this to maximise the chance that I reach my financial goals.

Why representation is important.

What helped me getting started was being able to see the impact of investing early and the contribution of compounding of returns in building wealth.

I first witnessed how investing contributed to building wealth when I was working at an asset manager that typically serviced wealthy clients. I was earning $54,000 a year, living out of home and living paycheck to paycheck. Day after day I saw investors that had patiently and consistently been contributing $100 – $200 a week over decades to create a better life for themselves.

This could’ve been one account that was part of a much larger portfolio, but I learned that investing was achievable on my salary. It encouraged me to start my investing journey much earlier than I would have otherwise. While this experience was foundational in my own journey it was a unique experience. Many women don’t have the experience of working in the investing industry which continues to be dominated by men.

The investing industry has cultivated a reputation as being inaccessible for the average Australian. It is filled with jargon and there’s high barriers to entry. Women and Money conducted a survey that reported that trust was a major issue for women. Women cited a ‘hidden agenda’ and felt that advice coming from financial professionals would be biased if it was in their interests. This study was conducted years after the Royal Commission in 2023 and following the mediation and revision of practices in financial services industry.

Another finding was the desire for women-centred services. This representation is important for many women to overcome the existing barriers to investing. Greater representation matters and is a fundamental step in building trust and loyalty. It is not just how advice is given but also who is giving the advice.

The success of women-led funds in Australia

Female representation can be found in some pockets of the industry. This was clear in Morningstar’s study of impressive women-led funds. These examples can help with women feeling more comfortable with financial products (as found in the Women and Money survey)Their success can also help with increasing the confidence of women which is a major barrier to getting started as investors.

Evidence suggests that just getting started is the key to women becoming successful investors. In 2017, Fidelity conducted a study on nearly 8 million account holders. The study found two revealing differences in the saving and investing habits of men and women. The first is that women save more than men. Women saved an annual average of 9 per cent of their pay compared to an average of 8.6 per cent for men.

Not only did they save more, but women also made better investors. Women outperformed men by 40 basis points, or 0.4 per cent. This seemingly small difference in savings rates and investment returns can make a big difference over the long term.

Fidelity asked the study participants who they believed was the better investor over the past year and only 9 per cent of women thought they had outperformed men. This lack of confidence has consequences. According to a study by Wealthsimple, women invest 40 per cent less money than men despite saving more. When asked in a survey by Lexington Law what they would do with an extra $1000, men were 35 per cent more likely to say they would invest the money.

However, the tides are changing. When we looked at the 2023 ASX Investor Study, we can see that women are getting more involved with investing. 42% of current investors are female, with half of all investors entering the market after 2020 being women.

Morningstar’s research into female portfolio managers

Morningstar’s fund and ETF ratings are based on three pillars – People, Process and Parent. We believe that quality of these pillars help investors determine whether the investment will outperform its respective benchmark on a risk-adjusted basis.

Morningstar has conducted research on the performance outcomes of women portfolio managers. This focuses on the ‘People’ pillar. We’ve found that funds and ETFs that are run by high-quality management teams deliver superior performance relative to their benchmark and/or peers. This assessment is taking an in-depth look at the managers’ and analyst teams experience and ability; their workload; the depth of direct and indirect resources that support them; and other factors such as whether they invest in their own funds, or whether they get paid incentives that are aligned with investors’ interests.

The research focuses on women who have achieved High or Above Average ratings for the People Pillar within the Australian investment universe, as evaluated by Morningstar analysts. This group consists of 62 strategies with female leads within investment teams that continue to help investors meet or exceed their financial goals.

Nikolai Bull, Manager Research Analyst behind the report found that the 62 portfolio management teams, when grouped, generated 1.2% alpha over the last 12 months on average. More impressively, they’ve achieved 0.89% alpha annualized over five years, as at December 2023. This is higher than the wider group of Australian equity managers with Above Average or High ratings for the People Pillar over the same period and showcases strength through diversity.

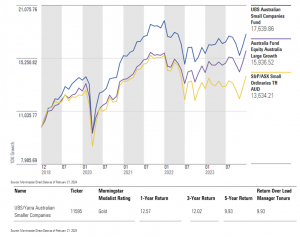

The research includes a closer look at three women fund managers with ‘High’ people scores, including Dawn Kanelleas at First Sentier Investors, and Katie Hudson from Yarra Capital Management. Both funds have earned a Gold medalist rating, indicating high conviction from our analysts on their ability to outperform their respective benchmarks on a risk-adjusted basis.

I will avoid making generalisations here because they will not be backed by data, and I acknowledge that regardless of gender we are all different. However, if you are a woman, or you know a woman that is reluctant to take the plunge into investing – point them to the fact that the statistics show they’ve got a good shot at this.

Regardless of gender, the best method is building an approach around yourself and investing for the long term. What helped me was being able to see the impact of investing early and the contribution of compounding of returns to building wealth. For others, it may be seeing how investing may bring financial independence and peace of mind. It could also be connecting it to tangible goals such as travelling, paying for education costs for children or helping elderly parents.

This article has been prepared by Morningstar Australasia Pty Ltd (AFSL: 240892). The information is general in nature and does not consider the financial situation of any individual. For more information refer to our Financial Services Guide at www.morningstar.com.au/s/fsg.pdf . You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.