28 Feb 2022 -The Perth Mint

The article is sponsored by The Perth Mint.

Gold prices have started 2022 on a positive note, rising beyond 1,900 US dollars and 2,600 Australian dollars per troy ounce (oz) in the first two months of the year.

A pullback in stock markets, conflict between Russia and the Ukraine, a crash in cryptocurrencies and fears over rising interest rates have all boosted the precious metal, with money flowing into gold products, including gold ETFs like Perth Mint Gold (ASX:PMGOLD)

In Australia, the move towards gold continues to be driven by SMSF trustees, who are increasingly holding allocations to the precious metal in their portfolios.

The role of gold in SMSF portfolios is a subject we address in our latest whitepaper, The return of inflation: Why gold is one of the highest performing asset classes investors can own.

The whitepaper covers a range of topics, starting with the key reasons gold pulled back in 2021 (a combination of very strong equity markets, a rising USD, better than expected economic growth and rising real bond yields in the first part of year), and why this pullback was healthy after gold’s circa 70% rise between Q3 2018 and Q3 2020.

It highlights factors suggesting the outlook for gold is more positive now, including how expensive equity and fixed income markets are. Interest rate hikes are also front of mind for investors today, with history suggesting they may prove a catalyst for higher, not lower gold prices.

This is captured in the table below, which shows the performance of gold in previous rate hike cycles in the United States.

RATE HIKE CYCLES AND US GOLD PRICE MOVES

Rate hike cycles and US gold price moves

The whitepaper covers the ongoing strategic reasons to include gold in a portfolio, given its one of the few assets that has historically offered both protection and growth to investors, as well as reasons investors shouldn’t fear gold’s volatility.

Finally, we take a look at inflation dynamics in the market today, highlighting several factors it could prove to be a major challenge to investors for most of the coming decade.

These factors include market cycles (we’ve had 40 years of declining inflation), ongoing supply chain issues, corporations looking to onshore, and climate change/net-zero initiatives.

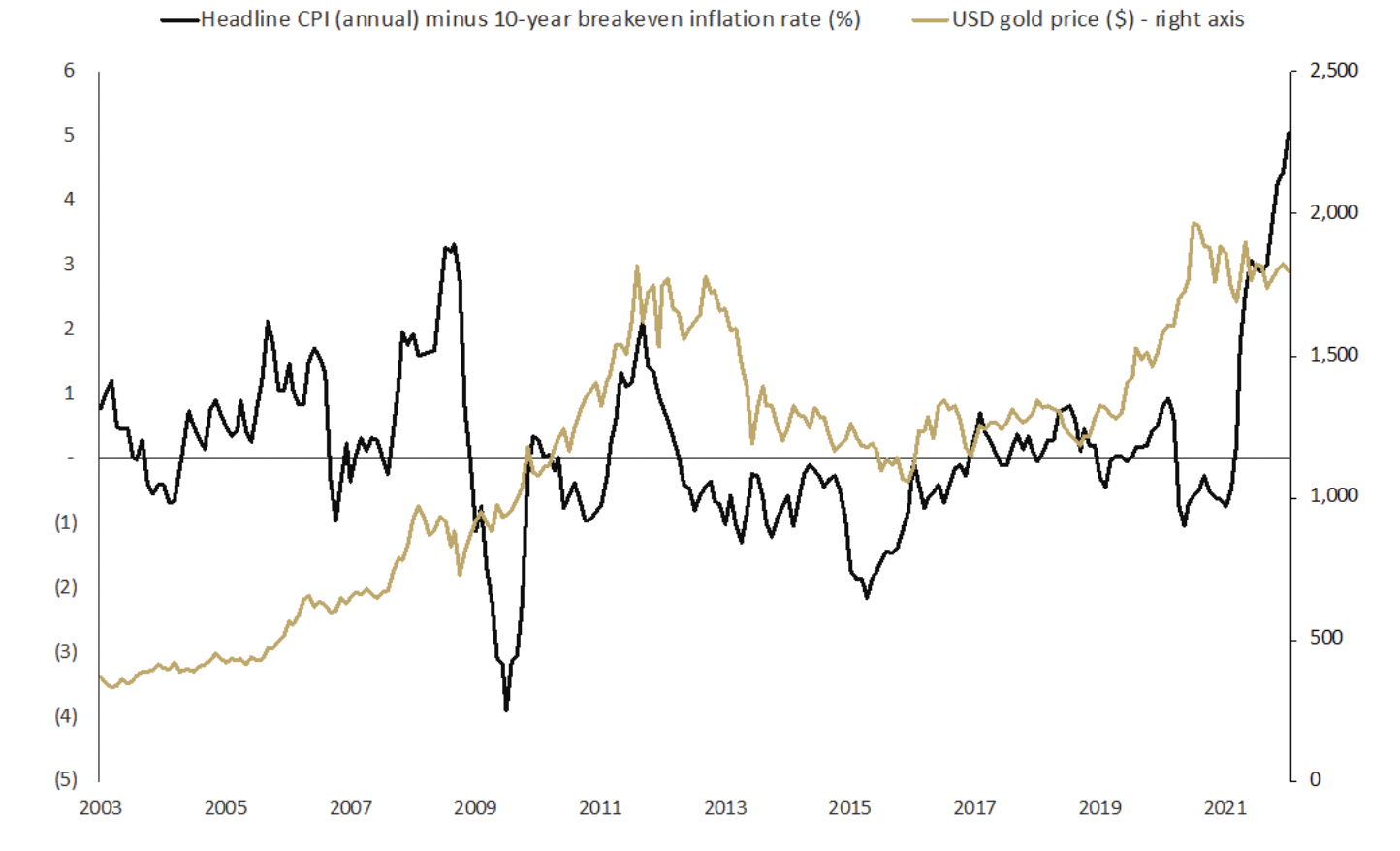

Given markets are not yet pricing in any meaningful long-term inflationary pressure (seen in the chart below which shows a record gap between headline annual CPI growth and the 10-year breakeven inflation rate), this could yet prove to be powerful catalyst for gold, if indeed inflation prove to be stickier, rather than transitory, going forward.

Source: The Perth Mint, LBMA, St Louis Fed, Cleveland Fed

You can download the full whitepaper here.

DISCLAIMER

Past performance does not guarantee future results. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. The Perth Mint is not a financial adviser. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. The Perth Mint is not liable for any loss caused, whether due to negligence or otherwise, arising from the use of, or reliance on, the information provided directly or indirectly, by use of this article.