By Jared Tilley, Senior Investment Specialist, NAOS Asset Management

Wednesday 6th March, 2024

Akin to Bill Murray in Groundhog Day, investors might be asking if emerging companies are stuck in a time loop. This time it’s not February 2nd, 1993, on repeat but the years of 2022 and 2023, where small companies are underperforming the rest of the market. Before we paint the picture for the future and why we don’t believe its “Groundhog Day”, it is worth looking at the underperformance of emerging companies over both the short term and the much longer term.

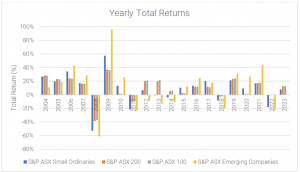

Emerging companies had a poor calendar year (CY) 2023, with the S&P/ASX Emerging Companies Index returning -0.4%, underperforming its larger counterparts the S&P/ASX 100 and 200 which returned +12.6% and +12.4% respectively. While emerging companies have underperformed the S&P/ASX 100 Index by a total of -36% over the last two years, there have also been periods where they have substantially outperformed their larger counterparts (2006, 2007, 2009, 2010, 2015-2017 and 2019-2022), as shown in the chart below.

Source – FactSet

When we look at long-term averages for the above indices, we come to expect a return closer to +8.0% p.a. Over the past 10 and 20 years, the return of the S&P/ASX Small Ordinaires Accumulation Index (XSOAI) has been +6.8% p.a. and +8.4% p.a. respectively.

Why are emerging companies underperforming in the current environment?

There is no one reason why small and emerging companies are underperforming so significantly but, in our view, the most plausible reasons include:

- Sharp Increase in Interest Rates – Over the past 2-years interest rates have increased at their fastest rate on record. This has led investors to reallocate funds to asset classes that arguably offer more attractive risk-adjusted returns i.e. term deposits or even private credit products.

- Economic Uncertainty – Another impact of interest rate increases is the accompanying increase in economic uncertainty, flowing into less certainty around the earnings trajectory of a business.

- Increase in Equity Risk Premium – Due to several factors, including the above, the premium that investors expect from a return perspective over and above the risk-free rate has increased. Where investors may have previously been satisfied with a 6-7% p.a. return from equities, this has increased sharply in the current environment and therefore demand for equities, especially at the smaller end of the market, has significantly reduced.

What is the catalyst for the end of “Groundhog Day” for emerging companies?

We can’t predict when the current bear market in emerging equities will end, but, in our view, some of the elements that are required for this to occur include the following:

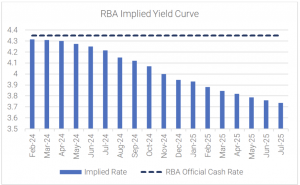

Interest Rate Ceiling – Investors feed off stability and predictability, and run from uncertainty. We don’t believe interest rates need to fall significantly for emerging equities to re-rate. All that investors (and businesses) need is some surety that interest rates have reached a ceiling and will not increase further over the short to medium term. The chart below shows the implied yield curve of the RBA Cash Rate, and while the rate isn’t forecasted to change significantly in the short term, there is a considerable reduction in late 2024.

Source – RBA

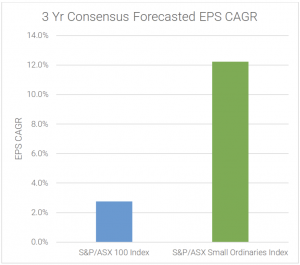

Earnings Growth – If businesses are able to provide a growing stream of predictable earnings growth, even at a moderate rate, we believe this will provide the impetus for increased investor interest. It is also worth noting that current market expectations are for the constituents of the S&P/ASX Small Ordinaries Index to provide earnings growth over the next 3 years substantially above that of the S&P/ASX 100 Index (depicted in the chart below).

Source – Factset

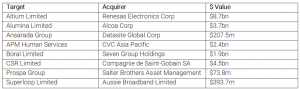

M&A – In our view, M&A activity in a market such as the one we are in can provide a level of confidence for investors that the valuations of public businesses are not reflective of their long-term outlook or potential. Since the start of February, we have seen several proposed deals of significant size announced, as listed below. This in our view indicates corporates and private equity firms, that have a long-term mindset, are taking advantage of the current dislocation in valuations.

Source – FactSet

Risk Premiums – If all of the above eventuate, then the premium that investors will demand from equity returns will decrease, which should therefore increase valuations prior to any earnings growth.

While there are a few uncertainties at the moment, the market is heavily discounting the long-term growth of emerging companies and it does feel as though emerging companies are repeating the same underperformance of CY22 and CY23,. However, we do not believe this will be the case for the remainder of 2024, and looking further ahead, in our view the valuation re-rate we will see in emerging companies over the next 3-5 years will be very meaningful.

Important Information: This material has been prepared by NAOS Asset Management Limited (ABN 23 107 624 126, AFSL 273529) and is provided for general information purposes only and must not be construed as investment advice. It does not take into account the investment objectives, financial situation or needs of any particular investor. Before making an investment decision, investors should consider obtaining professional investment advice that is tailored to their specific circumstances.