Simon Turner, Head of Content, InvestmentMarkets

14 March, 2024

You may have heard the joke about central bankers … how many central bankers does it take to change a light bulb? None. If the light bulb needed changing the market would have done it already. It won’t surprise you to hear not many central bankers find this joke funny. But what if the light bulb that needed changing was persistent inflation, and what if the market believes it can relax as the RBA has already changed that light bulb?

After the fastest rate raising cycle in Australian history, the RBA have remained on pause since November with the cash rate at 4.35%. Both the RBA and economists have celebrated the apparent death of inflation leading to markets pricing in rate cuts from September onwards. Hence, most economists expect the RBA’s cash rate to be lowered toward 3% during 2025.

However, a degree of scepticism about the consensual inflation narrative seems more than justified given the RBA’s and economists’ respective forecasting track records. We investigate below.

The RBA believe they’re on the home stretch with inflation

The RBA believe inflation is currently more under control than they’d expected a few months ago. In their February Statement on Monetary Policy, they mentioned, ‘Inflation is expected to decline a little quicker than previously thought.’

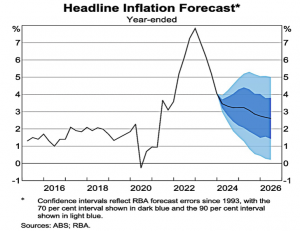

Progress has clearly been made in reducing inflation in recent months. As shown below, headline inflation has trended down to 4.1% (Q4 2023) from its 8% post-pandemic peak. The RBA expects CPI to further trend downwards to 2.8% by the second half of 2025.

https://www.rba.gov.au/publications/smp/2024/feb/outlook.html

The main reason for this pullback in inflation has been lower goods price inflation (3.8% in Q4 2023) reflecting an easing of upstream cost pressures as well as softer domestic demand. Importantly, Australian consumers have become adept at using the internet to source goods at the best available price which is helping reduce inflationary pressures. Fuel inflation has also been weaker than expected of late.

At the same time, services inflation (4.6% in Q4 2023) remains somewhat sticky. In particular, higher labour costs and non-labour costs such as insurance are contributing to ongoing services inflation.

Rent inflation (6.1% in Q4 2023) also remains a challenge reflecting the undersupply of rental properties around the country. It’s expected to remain high in 2024 before gradually easing thereafter. However, it’s noteworthy that the rental market is expected to remain undersupplied beyond 2024.

So in essence, the RBA’s confidence in reducing headline inflation from the current 4.1% to 2-3% comes down to services and rental inflation trending lower despite the ongoing challenges in both areas.

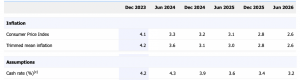

Confirming that narrative, here are the RBA’s current inflation and cash rate assumptions for the next couple of years:

Economists concur

Most economists either concur with the RBA’s outlook or are more dovish in that they expect lower rates than current RBA guidance implies in 2025.

Here are the rate forecasts of the big four banks:

- ANZ expects the RBA to start cutting rates around November with rates dropping to 3.6% by the middle of 2025 (in line with RBA guidance).

- NAB expects the RBA to start cutting rates in September with rates dropping to 3.1% by the end of 2025 (more dovish than RBA guidance).

- Westpac expects the RBA to start cutting rates in September with rates dropping to 3.1% by the end of 2025 (more dovish than RBA guidance).

- CommBank expects the RBA to start cutting in September with rates dropping to 2.85% by the middle of 2025 (more dovish than RBA guidance).

Global markets concur

Markets also believe that inflation is under control at a global level. This viewpoint is as consensual as they come. Check out the results of the recent BofA fund manager survey on this subject:

So should we agree with the RBA & economists?

In a word, no.

Let’s talk track records. The previous RBA governor didn’t become known in global markets as ‘Flip Flop Phil’ for no reason. After repeatedly not cutting rates when markets expected him to, and then guiding for flat rates for a period of years, Mr Lowe surprised markets by raising rates aggressively once it was obvious that inflation was running rampant. So it’s hard to argue the RBA’s forecasts or inflation goal were credible during his tenure. In fact, out of the 36 quarters under Mr Lowe’s leadership, inflation only came within the targeted range of 2-3% during two quarters.

Whilst Michele Bullock took over as the RBA governor last September, it may be advisable for investors to bear the RBA’s recent track record in mind, and therefore take their guidance with a grain of salt.

Most economists have a similarly poor track record of predicting where inflation and interest rates are going as illustrated by their collective shock at how aggressive the RBA’s recent rate raising cycle has been. So relying on their forecasts could also prove risky.

In Mark Twain’s words, ‘Whenever you find yourself on the side of the majority, it is time to pause and reflect.’

What if the RBA & economists are right about inflation?

Let’s start with the positive scenario markets want to believe is on track to happen.

If the RBA and economists are correct about global/Australian inflation being under control, there are a number of implications for investors:

- Falling interest rates are positive for asset values across the board, particularly for interest rate sensitive sectors such as commercial property and bonds which are likely to outperform in this scenario.

- Equity markets are likely to continue trending upwards in this scenario, particularly if a soft economic landing has been engineered.

- Growth stocks generally outperform in a falling rate environment since their discounted future cash flows increase more than for value stocks.

What if the RBA & economists are wrong about inflation?

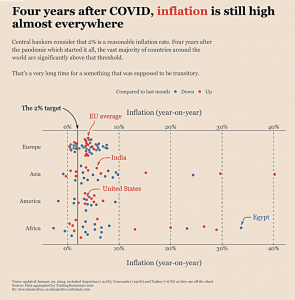

This more problematic scenario isn’t out of the realms of possibility given inflation has remained out of central bankers’ full control for four years, as shown below:

https://www.ecoinometrics.com/at-the-beginning-of-2024-inflation-is-high-in-all-countries/

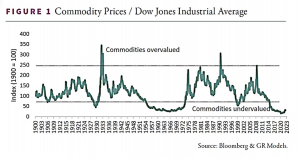

On that note, more than one professional investor has noticed that a number of key commodities have broken out of late which suggests the risks to inflation may remain on the upside:

So if markets are incorrect and global/Australian inflation is not under control, there are a number of implications for investors:

- The risk to interest rates still lies on the upside in this scenario despite the RBA’s and economists’ expectations.

- Interest rate sensitive sectors such as commercial property and bonds would still face a strong headwind which may lead to ongoing underperformance.

- Equities and other risk assets would be vulnerable to selloffs in the face of higher interest rates.

- However, equities which benefit from inflation such as commodity stocks may be positioned to outperform in this scenario. There’s plenty of catching up to be done in these assets as shown below.

- Value stocks also generally outperform in a rising rate environment since their discounted future cash flows decrease less than for growth stocks.

Inflation expectations matter

With the RBA and economists believing that inflation is under control and that interest rates are likely to trend lower from here, it may be worth keeping an eye on what could happen if that playbook is wrong.

If inflation were to remain higher for longer, the implications for Australian investors are profound, particularly given the market’s current complacency about this scenario occurring. If the RBA didn’t change that lightbulb we all thought had been changed, we may be facing some darkness in the short term.