By Jason Beddow, Managing Director, and Meredith Hemsley, Communications Manager, Argo Investments (ASX code: ARG)

Share price premiums and discounts are a unique feature of Listed Investment Companies (LICs) that, when properly understood, can help savvy investors identify long-term investment opportunities.

What exactly is a premium or a discount?

You may have heard a LIC described as trading at a discount or premium, and wondered, what does this mean? And why does it happen?

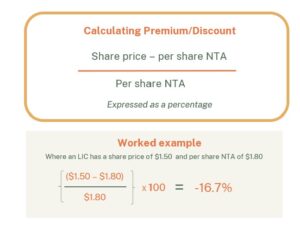

Because a LIC is a closed-end structure, its share price can trade above or below the value of its underlying portfolio on a per share basis. This is described as its net tangible assets (NTA).

A LIC’s share price fluctuates and reflects what buyers and sellers are willing to pay, which may not always match the LIC’s underlying NTA per share.

When the share price trades below NTA, the LIC is said to be trading at a discount. When it trades above NTA, the LIC is said to be trading at a premium.

Ideally, Investors should seek to buy LIC shares at a discount to their underlying NTA, and sell them at a premium, thereby enhancing the performance of their investment.

Why do LICs trade at premiums or discounts?

These movements reflect investor demand, which is influenced by both broad market conditions and LIC-specific factors.

External factors: the investment environment

Interest rates can play a major role. When rates rise, some income-focused investors rotate into term deposits or other interest-bearing instruments, and LIC discounts can widen. When rates fall, LICs can see renewed demand as dividends become more attractive relative to interest on cash. This is particularly the case for established LICs with long histories of paying reliable fully franked dividends, through various economic cycles.

Broader market sentiment and prevailing investor preferences can also influence demand. In ‘risk-on’ periods, investors may favour higher-growth or cyclical sectors, and demand for more conservative income-style LICs can soften, widening discounts. This trend can reverse during more volatile or ‘risk-off’ periods, when demand returns to assets offering stable, reliable income, potentially narrowing share price discounts, or even leading to premiums.

Internal factors: specific to the LIC

Premiums and discounts are also shaped by how attractive a particular LIC is to investors. Key drivers include:

- Dividend track record and franking: LICs with a well-established track record of paying steady, fully franked dividends often see more stable demand over the long term. Higher dividend yields can often lead to premiums to NTA.

- Investment performance and trust: LICs with strong long-term performance and effective communication of their investment strategy may trade closer to NTA (or at a premium).

- Fee and cost structure: Higher fees and other costs can reduce the appeal of the LIC and diminish NTA performance, contributing to wider discounts over time. To learn more, see our recent article on the difference between internally and externally managed LICs.

- Liquidity and size: Smaller, less liquid LICs tend to trade at wider, more persistent discounts.

- Communication and transparency: Clear reporting (including NTA reporting), frequent updates, and a strategy that investors understand can support confidence and demand.

Narrowing discounts

LIC boards and managers can take proactive steps to address wide and prolonged discounts, although not all drivers are within their control. Common tools include:

- On-market buy-backs: Buying back shares at a discount to NTA and cancelling them can increase the NTA value per remaining share (often described as ‘NTA accretive’).

- Managing dividend reinvestment plans (DRPs): This may include buying the shares on-market for DRP participants at a discount to NTA, rather than issuing new shares at a discount (often referred to as ‘DRP neutralisation’).

- Improved communication and engagement: Clear explanations of strategy, portfolio positioning, dividend policy and NTA movements can help shareholders better understand what they own and attract new shareholders, increasing demand for the shares. LICs which have a track record of being ‘true to label’, transparent in their actions and accessible to investors can develop loyal shareholder bases.

- Dividend stability: Maintaining sustainable dividends through market cycles can build confidence, especially during periods of volatility.

Of course, some factors contributing to discounts are out of the LIC’s control. For instance, a LIC can’t influence the interest rate environment or immediately generate enthusiasm for an investment strategy or asset class that is out of favour with investors. Furthermore, a LIC’s size and liquidity, especially in its early years, can pose structural constraints that take time to improve.

Case study: Argo Investments

Over time, Argo Investments (ASX: ARG) has traded at both premiums and discounts to its NTA in a largely cyclical fashion. Like many across the sector, Argo is currently trading at a discount. However, over the longer term, historical data shows that, on average, Argo trades very close to its NTA.

In our view, Argo’s premium or discount is often closely correlated with the Reserve Bank of Australia’s cash rate. This was clearly illustrated during COVID, when the RBA adopted extremely loose monetary policy settings. With the cash rate near zero and returns on cash investments (like term deposits) negligible, demand for Argo shares grew, sending the share price higher to trade at a premium to NTA.

In short, strong demand for fully franked dividends has tended to support a narrower discount or premium, while ‘risk-on’ periods can see discounts widen as investors favour higher-growth themes.

Discount opportunities

Discounts can provide investors with a compelling opportunity to buy a portfolio of assets at a discount to their underlying value. Over time, changes in the investment environment and proactive steps taken by the LIC may help narrow the discount. This ‘discount capture’ strategy may prove very fruitful for patient, long-term investors.