By Jason Beddow, Managing Director, and Meredith Hemsley, Communications Manager, Argo Investments (ASX code: ARG)

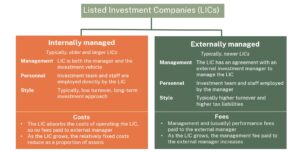

Listed Investment Companies (LICs) are well-known among Australian investors. However, the difference between internally managed and externally managed LICs isn’t always clear. The distinction can be relevant when it comes to thinking about alignment of interests, fees or costs, investment behaviour and shareholder returns over time.

Common features and benefits

Just like other Australian shares, LICs are bought and sold on the Australian Securities Exchange (ASX). LICs use a company structure, are subject to board oversight and operate under Australia’s corporate governance regime.

Importantly, because LICs are Australian corporate taxpayers, they can generate franking credits by paying company tax on taxable income and realised gains, in addition to any franking received from their underlying portfolio. LICs can build franking balances over time and distribute those credits with dividends.

Depending on the LIC and its franking balance, this may enable it to pay fully franked dividends. This can be a benefit of the LIC structure compared with an exchange-traded fund (ETF), which can only pass through franking credits it receives from its underlying holdings and does not generate franking credits itself.

Internally managed LICs

Many of Australia’s largest and oldest LICs are internally managed, such as Australian Foundation Investment Company (ASX: AFI), founded in 1928 and Argo Investments (ASX: ARG), established in 1946. These LICs employ their own in-house investment and management teams and therefore operate as both the manager and the investment vehicle. As a result, these LICs do not need to pay fees to external managers.

All operating costs (staff, research tools, regulatory costs etc.) are captured within the Management Expense Ratio (MER) and are accounted for in the reported net tangible asset (NTA) performance. As the internally managed LIC grows, its largely fixed operating expenses tend to fall as a proportion of assets. For large, long-established LICs, the MER is usually between 0.1% and 0.2%, although this varies by LIC. They tend to be low-turnover, long-term investors.

In a nutshell, an internally managed LIC is operated solely for the benefit of its shareholders, with no leakage of fees to an external investment manager.

Externally managed LICs

Externally managed LICs operate differently. These are LICs that have commonly been listed since the early 2000s. They appoint an external fund manager under a management agreement and pay a fee to that manager based on a percentage of the LIC’s assets. The management fee is often between 0.7% and 1.0%, sometimes as high as 2.0%, depending on the investment strategy. These LICs will typically also pay performance fees to the external manager for outperforming a benchmark index or other performance hurdle.

These managers may pursue more active or specialist strategies. Many investors prefer these strategies because they offer access to a particular manager or less accessible strategies or asset classes (for example, international markets, private equity or private debt), often with a relatively small minimum investment via the ASX. As fee structures differ from internal management, incentives can also differ, encouraging higher turnover or greater emphasis on short-term relative performance.

To sum it up

Neither structure guarantees better performance. Some investors prefer the simplicity, alignment and cost discipline of internal management, while others are happy to pay higher fees for a specialist strategy or a fund manager. What matters is understanding how each structure works, comparing them on a like-for-like basis and choosing the LIC that best fits your objectives and comfort with fees or costs.

To learn more about Argo Investments, visit their website here.