Understanding Company Moats in Investing

By Owen Rask, Investment Analyst and Host of The Australian Investors Podcast

15 March 2023

A moat is a ring of water that keeps enemies out of castles.

In investing, a moat is the ‘thing’ that keeps competitors away from your core business. Aside from the usual suspects, the book called Value Investing by Bruce Greenwald illustrates the power of moats/competitive advantages and franchises. Greenwald showcases why companies often destroy shareholder value when they invest outside of their moats.

It’s like in those medieval movies when the King sends his soldiers outside of the castle to fight and the only thing on your mind is, “What in the flamin’ heck are you doing? Keep them inside the walls!”

The pioneer in understanding competitive advantages/moats is Michael Porter, author of Competitive Strategy (1980) and Competitive Advantage (1985). He’s also one of the authors of Harvard Business Review’s 10 Must Reads – On Strategy. You’ll learn an important technique from Porter, below.

To summarise, a moat is a feature of a business that enables it to generate excess returns on capital for a sustained period. Under the rules of capitalism, usually, a competitor would enter the market and eat away at those returns.

But enough of the legacy and theory, let’s jump in with some examples…

Morningstar’s 5 moats

Morningstar’s global investment analyst team spend much of their days doing two things: valuing companies and assigning moat ratings (none, narrow, wide). Their team has identified five types of competitive advantages/moats (from now on, I’ll refer to them as moats).

Here are the five types of advantages:

1. Network effects

A network effect occurs when something (e.g. Facebook, TikTok, YouTube, payment networks, Amazon, Vanguard, etc.) becomes more valuable as more people use it. To identify these companies, what you’re looking for are rapidly rising user/customer numbers — with a lower per-unit marketing or sales expense.

This relationship may be a strong signal to you that the company is growing faster with less effort. That is the essence of a network effect.

2. Intangible assets

Apple. Commonwealth Bank. Twitter. Intangible assets often include brands, patents, copyright and just about anything else that makes a product or service ‘special’ (e.g. Disney’s cartoons, Lego, McDonald’s).

David Gardner, co-founder of The Motley Fool and a tremendous investor has something called a “snap test”. Click your fingers and imagine the company’s products or services disappear. Would you notice? While not a perfect corollary, it’s a neat way to think of brands and products as valuable.

Interestingly, I believe investors often think that intangible assets are strictly limited to brands or patents. I’ve found that simple things like customer email lists or legacy partnerships can yield higher returns. The idea is that whatever ‘asset’ the company might own will lower the search cost/effort of a purchaser, may enable the owner to increase the price for the product, and is hard to quantify on a balance sheet.

For example, if you go to the supermarket and you want baked beans. You see Heinz. “That’s good enough” is probably what you’ll say — even if there’s a 50 cents cheaper product next to it. Why? You know the Heinz brand, so you don’t need to keep searching for alternatives and you’re happy to pay for the taste or flavour.

3. Cost advantage

This is a supply-side advantage and is often part of the ‘secret sauce’ for companies such as Coles, Woolworths, Aldi, Walmart (USA), etc. Along with efficient scale (below), it’s also a source of the moat for mining companies (e.g. BHP, Rio Tinto).

Some investors believe that the only true durable advantage of a company is a supply-side advantage and that the key way to measure it is via replication: how long would it take and how much money would you need to replicate the company’s supply-side advantage?

For example, Fortescue Metals Group has its own mine site, trains, rail network, ports and ships for its iron ore. It’s no wonder it’s one of the lowest-cost iron ore miners in the world and now (after many years of struggle) earns outlandishly high returns on invested capital (ROIC) when iron ore prices are at reasonable levels.

4. Switching costs

These are costs that make it hard — or impossible — for customers to give up a service or product. This ‘power’ means the company can raise prices. A subscription to Xero or Intuit’s Quickbooks accounting software would be extremely difficult for accountants to cancel. And Microsoft’s Office bundle is a mainstay in workplaces for this exact reason.

5. Efficient scale

Some businesses or industries carve out a moat by simply being the biggest in that sector or ‘vertical’. These are often — but not always — ‘niche’ markets that can be very technical (e.g. the glues and adhesives market, aeroplane parts, etc.) and it’s not worth a new company entering.

For example, APA is Australia’s largest gas pipeline operator. For a new company to compete against APA it would cost billions and billions of dollars to build the same infrastructure, but the rewards for building all of that infrastructure are probably not worth it since most of the demand is catered for by APA. This means APA’s top spot is rarely challenged.

There are many different types of competitive advantage, these are just ways to bucket them in your portfolio or during your research process.

How to stress-test a moat

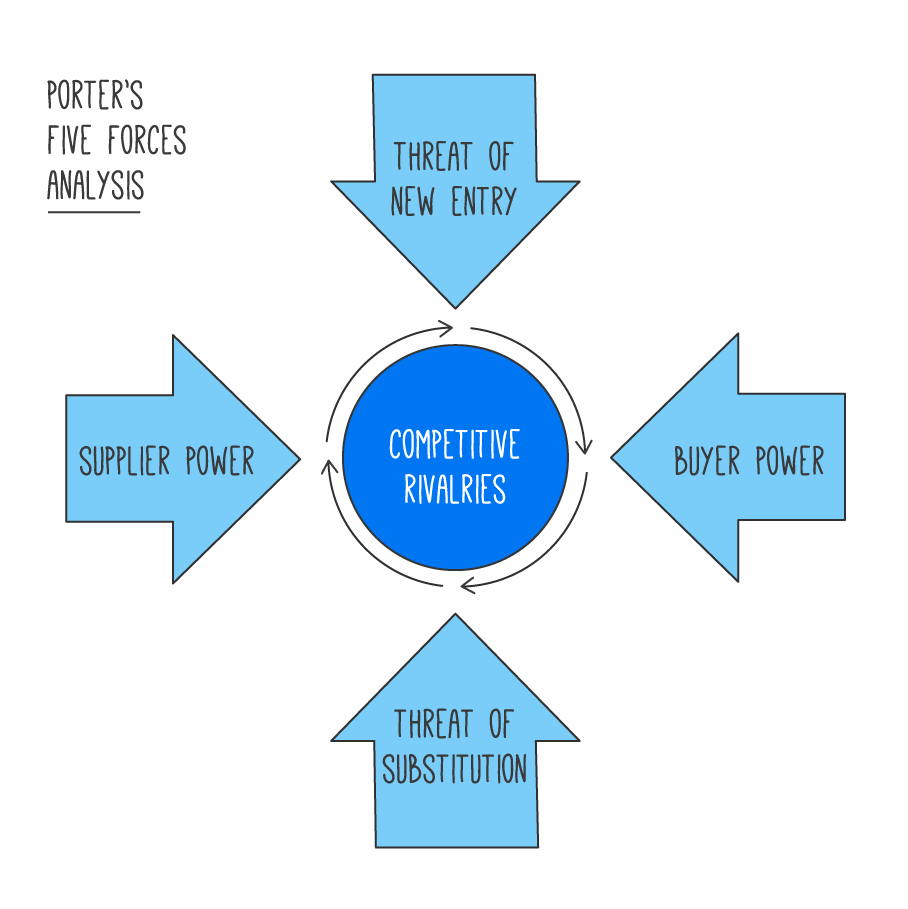

Porter’s Five Forces is one of the most powerful tools that portfolio managers and analysts should use to understand the opportunity for a business.

What’s especially surprising to me is that many Australian analysts and investors have never even heard of Porter’s Five Forces, let alone use it in their analysis. Overseas, in places such as the USA, Europe, and South Africa, this is a more popular tool used to ‘stress test’ a competitive advantage.

In short, the true test of a moat is the ability to increase prices and retain/grow the customer base. This proves to you that the company has a “sticky” product and pricing power.

But how do you determine if a company may have pricing power in the future? How do you identify if a company has the potential to create a wide moat in time?

Porter’s Five Forces can be used to prompt you to identify where a moat may be weak or strong, after considering all of the usual forces that can impact it.

It’s important to think of the company’s advantage from five perspectives and, as you can see in the table above, quiz yourself to understand where the balance of power may lie. For example, if you were studying a purely cloud-based accounting system like Xero in 2014. At the time there were heaps of competitors, such as MYOB, Reckon and Quickbooks. But none of them offered cloud-based accounting because they were stuck on desktop computers with CDs and dozens of different versions, making them unstable, hard to update and different to use on the road. Accountants hated them.

For Xero, there were many competitors, but their capabilities weren’t as strong as many expected. Xero had a unique product and knew that once accountants uploaded all of their client’s accounts they were unlikely to switch. Xero also didn’t have to rely on any suppliers for parts (like a manufacturer) or distribution (e.g. via CDs or retailers) — because it was all cloud-based.

A newer cloud-based product was eventually introduced by Quickbooks but it was still obvious that the first few products were inferior to Xero, and as Xero grew in popularity and started throwing conferences (“Xerocon”) to celebrate accountants, it quickly harnessed a strong network effect and benefited from massive economies of scale (more accountants = more users = more accountants = more developers building inside the Xero app store = a stickier product).

Porter’s 5 Forces could have helped you look deeper into Xero and discover a remarkable company.

Here’s a funny story. I worked in an office of accountants who refused to migrate to the cloud (until Covid hit and they couldn’t work from home). They also told me things like, “Xero is amazing software… but I’d never own the stock because it’s not profitable.” They couldn’t see past the profit/loss to see that what Xero was building was an incredible network that would, one day, blast past its inflection point (keep reading to find out what this means) and into profitability.