Simon Turner, Head of Content, InvestmentMarkets

21 March, 2024

Welcome to the match of the year … it’s growth versus value stocks.

The audience are on the edge of their seats. Most are rooting for the team they have a natural bias toward. Those who tend to buy products at the supermarket when they are on sale are generally supporting the value team. Whereas, those who are more likely to pay up for high quality products they expect to last longer tend to be supporting the growth team. Both types of supporters are passionate about their players, and both believe they are on the winning side.

The timing of the match is important. Rightly or wrongly, markets believe interest rates have peaked, and are due to be cut by the RBA in the coming months. If that viewpoint is correct, then the changing direction of future interest rates is likely to influence which team is more likely to win this year.

To the match … the two teams will be tested against one another on four key factors for a steer as to which style is best positioned to outperform over the remaining three quarters of 2024.

Test one: performance in a falling interest rate environment

To kick off the match, the performance of growth and value stocks will be compared in a falling interest rate environment since the market is expecting the RBA to deliver rate cuts from September onwards.

Recent performance is a good place to begin this contest since markets began pricing in interest rate cuts by the Fed and the RBA throughout 2023. As shown below, growth stocks have been strongly outperforming value stocks throughout that period, and are continuing to do so year-to-date.

Growth stock outperformance ahead of rate cuts makes intuitive sense.

In a falling interest rate environment, the value of discounted future cash flows increases more for growth companies, which have a higher portion of their expected cash flows in the future, than for value stocks. That means growth stocks should theoretically outperform in a falling interest rate environment, and vice versa.

So growth stocks have won this point, right?

Not so fast.

In a recent Bloomberg article, Nir Kaissar, the founder of Unison Advisors, revealed research on growth and value stocks’ performances during previous interest rate cycles dating back to 1954. His research included 12 periods of rising rates and 11 periods of falling rates.

The results showed that value outperformed growth in 10 of the 12 periods of rising rates. So far, so good for the growth team. That finding aligns with most financial theories. However, more surprisingly, value also outperformed growth in 9 out of the 11 periods of falling rates. So value outperformed in 19 of the 23 selected periods, or 83% of the time.

Without a referee to call upon, it looks like the value team have snatched what should have been an easy point away from the growth team. One-nil to the value team. Growth supporters are feeling robbed and may want to appeal this decision.

Test two: the long term data

For the next test, let’s step back for a big picture view of the longer term data comparing how growth and value stocks perform.

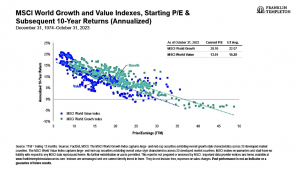

As shown below, the data shows that value stocks are a safer bet for investors aiming to avoid loss-makers, whilst the cluster of the strongest winners is also dominated by value stocks. The data also reveals growth stocks to be more hit and miss than value stocks with a significant portion not living up to their promise.

This data confirms that value stocks have a natural advantage over growth stocks in the form of their lower starting valuations which leaves room for upward revaluations, as well as their higher average dividend yields.

A higher long term success rate and a lower chance of investing in loss-makers translates into an uncontentious point for the value team. They move to a two-nil lead.

Test three: relative valuations

The next battle compares the relative performance of growth and value stocks in recent years.

Growth stocks are currently trading at around double their long-term premium versus value stocks which has driven them to around their long term highs relative to value—as shown below.

Whilst growth stocks could break out to the upside versus value from here, it generally pays to be cautious on an investment style when it’s unusually expensive like this.

Recent Franklin Templeton research concurs: “Monetary policy normalization in many countries should further positively impact certain value-oriented sectors. Higher interest rates have lured capital away from dividend-paying industries toward fixed income over the past year. For value investors, the drop in valuations in the consumer staples, utilities and real estate sectors, for instance, can create greater prospects of finding stocks unfairly trading below their fundamental value.”

So whilst continued outperformance by the growth team remains a possibility, growth stocks are now in the realms of being very expensive versus value. Hence, this point has to go to the value team although growth supporters are starting to get vocal in the stands. Three-nil to the value team.

Test four: the predictability and persistence of growth

The final challenge is customised to test the predictability and persistence of growth expectations.

This is key information in this contest since the persistence of growth is at the heart of the valuation differential between growth and value stocks.

In simple terms, when growth is persistent, it makes intuitive sense to pay a higher premium for it as markets are doing at present. However, when growth is not persistent, there’s a weaker argument to pay a premium for growth stocks, and a stronger argument in favour of value stocks outperforming.

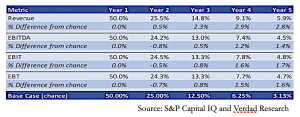

To the data … the most recent research on this issue, was completed in October 2022 by Brian Chingono and Greg Obenshain of Verdad. Growth supporters look away. As shown below, they analysed the performance of US stocks between 1997 and 2022, and made the concerning discovery that there’s no evidence supporting the persistence of growth over the long term on four key measures of growth.

It’s hard to argue with those numbers no matter how much growth supporters want them to reveal a different conclusion. If growth is not persistent, then markets should be valuing growth stocks at a relatively low premium versus value stocks, unlike at present.

That was an easy point for the value team which brings the match to a close.

And the winner is…

It was a well-fought match between growth and value stocks, but only one can stand victorious. Based on the above-mentioned factors, the winning investment style for the remaining three quarters of 2024 appears likely to be value stocks with a four-nil win over growth stocks.

The arguments in favour of value at this juncture are compelling. Value stocks are unusually cheap versus growth stocks, growth stocks have already strongly outperformed, whilst the long term data is supportive of value stock outperformance and unsupportive of the persistence of growth.

However, there’s a but and it’s a big one. Growth stocks, particularly the Mag7 stocks, have had momentum on their side for some time now, so investors’ muscle memory may be programmed to keep buying these stocks on any weakness. Picking the exact moment that one investment style will begin outperforming is almost impossible.

That’s the match of the year at the end of the first quarter. We’ll revisit the game later in the year when both teams have regrouped after this hard-fought battle. In the meantime, good luck picking the team you support.