Simon Turner, Head of Content, InvestmentMarkets

3 April, 2024

If you’ve notice the growing popularity of managed funds of late, you aren’t alone. After a challenging couple of years, Australia’s managed fund sector resumed growing its funds under management around eighteen months ago. The recent rally in global equity markets is clearly a key driver. But there’s more at play here. Financial advisers appear to be warming to managed funds in a way they haven’t for some time. We investigate why below.

The headwind created by the managed accounts boom

Let’s start by discussing one of the stronger headwinds the managed fund sector has been up against in recent years: competition from managed accounts.

A growing number of financial advisers have been advising that their clients invest in managed accounts, often to the detriment of the managed fund sector.

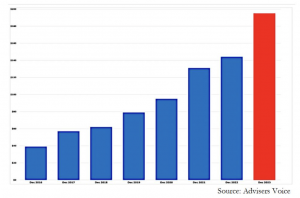

As a result, the boom in managed accounts’ funds under management has been dramatic in recent years:

Annual Growth in Managed Accounts (Funds under Management $bn):

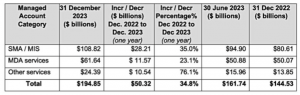

All types of managed accounts, including separately managed accounts (SMAs) and managed discretionary accounts (MDAs), have benefitted from this trend:

So why are managed accounts’ funds under management booming?

In essence, more and more financial advisers have been recommending that their clients invest via managed accounts due to the growing regulatory burdens they’re bearing. The main advantage of managed accounts is that they don’t require advisers to complete a record of advice every time a change is made to a portfolio. That’s great news if you’re an overstretched adviser doing your best to manage all your clients’ accounts to the best of your ability while keeping the regulators happy.

Hence, the growth in managed accounts’ funds under management is about advisers ensuring their clients can achieve their investment goals in an efficient and sustainable manner for all involved.

But what about managed funds?

When posed with the prospect of investing in managed accounts, more than one client has asked the question: what about the humble managed fund?

The reason this question seems obvious to ask is that managed funds address the same regulatory challenge for advisers as managed accounts: managed funds’ portfolio management activities can occur without consultation or documentation.

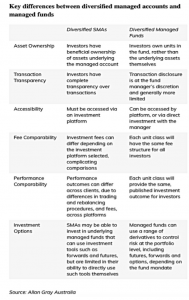

Having said that, there are a few noteworthy differences between managed accounts and managed funds as shown below.

Minor differences asides, a noteworthy shift in financial adviser attitudes toward managed funds has been occurring in recent years.

In the past, it was common for financial advisers to view managed funds as a relatively high risk investment strategy, particularly when there was a potential mismatch versus their clients’ risk profiles or return objectives.

However, the recent boom in managed accounts has highlighted to some advisers that investing in a single managed account is in fact similar to investing in a single managed fund. They’re both managed by an external fund manager who’s aiming to outperform by investing in a diverse portfolio of assets.

In addition, many of those same advisers have rediscovered the benefits of investing in managed funds. Namely:

- Ease and simplicity – All investors in managed funds generate the same returns and pay the same fees, so there’s no risk that some clients underperform others. That’s an important advantage for advisers. In addition, managed funds are already established at the time of clients’ initial investments so the investment process is simpler and easier than for most managed accounts.

- Access to high-quality opportunities – Larger managed funds tend to gain access to a wide range of investment opportunities which are challenging for most investors to access. These managers often have specialist experts within their teams who can develop the relationships needed to gain access to high quality deals, and they are able to delve deep into the details for the benefit of the fund.

As a result, with more advisers realising that managed funds have a growing role to play in their clients’ investment portfolios the makings of a renaissance in managed funds appears to have begun.

Managed funds on the rise

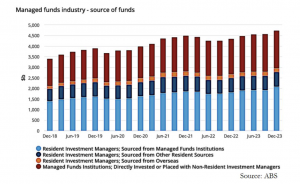

Partially as a result of the above-mentioned shift, Australian managed funds are once again on the rise as an asset class:

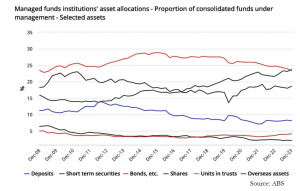

On that note, the recent asset allocation shifts across the diverse managed funds asset class are worth keeping an eye on:

Since the March 2020 pandemic low, overseas and domestic equity allocations have been rising at the expense of unit trusts, term deposits, short term securities, and bond allocations. In short, managed funds have been increasing their exposure to the strongest performing asset classes, and vice versa.

Further growth in managed funds’ assets under management could well lead to a continuation of these recent trends.

A growing mainstream asset class

So inflows are the name of the game in the managed funds sector. With more financial advisers allocating a portion of their clients’ portfolios to managed funds than for some time, the sector has resumed growing over the past eighteen months. This shift, combined with a positive period of global equity market performance, suggests the renaissance of the managed fund sector is likely to continue.

Originally published on InvestmentMarkets