Simon Turner, Head of Content, InvestmentMarkets

1st March, 2024

Most investors currently lack exposure to emerging markets after a generally challenging decade for the asset class prior to 2023. However, over the past year the emerging markets narrative has improved for some structurally-attractive emerging market countries where stock market momentum continues to build.

We explore how the emerging markets narrative has evolved and why investors should watch out for buying opportunities that present themselves this year …

Change is afoot

As has been the case for decades, US interest rates have been an important theme across emerging markets during the Fed’s rate raising cycle, but for different reasons versus recent history.

In the past, rising US interest rates generally led to collapsing emerging market currencies which created significant problems for local investors borrowing in US dollars. Weaker currencies also typically led to imported inflation which in turn pushed local interest rates higher and economic growth lower. This vicious cycle tended to last longer and impacted financial returns to a greater extent than most foreign investors were prepared to tolerate.

However, during the Fed’s recent rate raising cycle, the four most dangerous words in finance seem to ring true for emerging markets as an asset class … this time is different.

In contrast to analysts’ expectations that foreign capital would flee emerging market en masse in a rising US interest rate environment, in the main that hasn’t occurred this time.

The fact that the present day playbook is not following this timeworn pathway is worthy of investors’ attention. When fundamental change in a long term narrative occurs like this, there are often compelling opportunities for investors to benefit from the shift.

What’s behind the change?

Most analysts agree that emerging market central banks are behind the fundamental change that’s occurred over the past year or so. In particular, the way these central banks have collectively responded to the recent emergence of inflation and the Fed’s rate raising strategy has ensured they are not behind the curve as they were in previous cycles.

Case in point … Latin American central banks were actually ahead of the Fed in raising rates this cycle with an average 4% of rate increases locked in before the Fed started raising rates. Elina Ribakova of the Peterson Institute for International Economics praised those central banks for this proactive and hawkish approach inspired by the risk of Fed contagion and their previous challenges at addressing inflation.

The results speak for themselves. Throughout 2023, emerging market economic growth expectations were consistently revised upwards, particularly in large countries such as India, Mexico and Brazil. At the same time, foreign investors were generally more willing to lend to local borrowers in their local currencies.

Supportive structural factors

The positive evolution in the emerging markets narrative doesn’t stop there. There are a couple of noteworthy structural factors which will continue supporting emerging markets as an asset class over the longer term:

- The net zero transition requires enormous quantities of critical materials which are often exported from emerging markets such as Chile, Mexico and China.

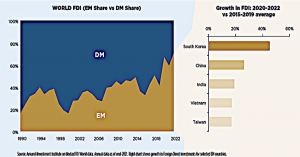

- The trend towards global fragmentation is leading to more friend-shoring, supply de-risking and a growing allocation of capital employed going to emerging markets. As a result, emerging markets are attracting a rising portion of foreign direct investment (FDI)—as shown below.

These structural factors explain why emerging market economies are positioned to continue outgrowing developed market economies over the longer term.

Not all emerging markets are created equal

Despite these positive developments, not all emerging markets are as well positioned to outperform.

India versus China is a case in point …

India leading the way

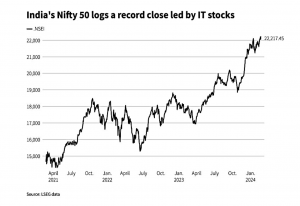

Two months into 2024 and India is once again one of the best performing emerging markets as shown below.

It’s easy to understand why India is outperforming. In contrast to China, India’s demographics are favourable with nearly 80% of its 1.4 billion population being under 50 years old. That translates into enormous addressable markets of employed consumers centred around a fast growing middle class.

India’s political situation is also supportive. The country faces a leadership vote in a few months, and Narendra Modi, one of the country’s most popular prime ministers in generations appears likely to win a third term. Financial markets would likely view that as a positive outcome as it would allow the government to continue its policies to help translate the country’s productivity-boosting manufacturing capabilities into economic growth.

However, it’s worth noting that Indian equities have already outperformed strongly. A short-term pause in the rally is to be expected soon given valuations are looking stretched versus recent history. For example, the Nifty50 is trading at a relatively rich forward P/E ratio of around 19 times.

Despite higher valuations, India’s longer term outlook is bright and equity investors are likely to benefit. In terms of upcoming catalysts, the Reserve Bank of India is expected to start cutting rates later this year at the earliest. That could prove to be the trigger that drives this buoyant country’s stocks higher.

China at the back of the pack

Up until three years ago, China shone bright as the emerging market of choice for many foreign investors. Whilst volatile, the Hang Seng’s returns had consistently outperformed the vast majority of emerging markets over the long term.

However, that’s all changed. Since then, the Hang Seng has lost almost half its value, and has started 2024 with its worst performance in five years as shown below.

Whilst the Chinese economy reportedly grew at a solid rate of over 5% during 2023, foreign investors remain cautious.

The recent Chinese property sector crisis is at the heart of investors’ concerns, but at a more fundamental level investors are worried that the country is not as investor-friendly as it used to be. A string of regulatory crackdowns by the government has led to a dramatic outflow of foreign capital. That shift has led to an increase in the country’s risk premium and cost of capital reflecting the heightened risks.

As a result of recent underperformance, Chinese stock valuations are unusually low at present. According to Deutsche Bank estimates, the Hang Seng index is currently trading at a forward P/E ratio of only 8 times.

Whilst a turnaround could eventuate this year given valuations have fallen so far, it’s unlikely China will be a top performing emerging market in the short term given the ongoing property sector and regulatory headwinds. In addition, demographic ageing and geopolitical fragmentation present longer term structural challenges for this market.

Having said that, at a recent investment conference, more than 40% of polled participants regarded China as “uninvestible” which tends to be a leading signal of better days ahead.

Keep an eye on global economic growth

When investing in emerging markets, it pays to keep a close eye on global economic growth since slowing global growth tends to hit emerging market economies harder than developed economies. That’s arguably the biggest risk investors face this year.

However, at this point 2024 is shaping up as another year of solid emerging markets economic growth. Amundi expects emerging markets economic growth to slow slightly from 4% in 2023 to 3.6% this year.

Using 2023 as a guide, there are also economic upside risks to be aware of. For example, if the Fed were to start cutting rates during 2024 as markets currently expect, that’s likely to provide a solid backdrop for global and emerging markets economic growth expectations to be met, or even exceeded.

Be selective & patient

The emerging markets narrative has evolved in profound ways of late, and will continue to evolve as these markets further develop.

The longer term emerging markets outlook is bullish driven by structural factors and improved central bank standards. However, the shorter outlook is more nuanced at a country level. Investing in emerging markets undergoing positive structural changes that are creating economic tailwinds (eg. India, Brazil, and Mexico) is likely to prove fruitful, whilst investing in emerging markets facing structural challenges (eg. China) may remain a challenging strategy.

Investing in emerging markets via a fund manager with local market expertise remains a prudent option for most Australian investors. With global equity markets looking overbought at this juncture, it may be sensible to await the inevitable return of volatility to gain exposure to compelling emerging markets stocks and funds.