By Robert Miller, Portfolio Manager, NAOS Asset Management

30 May 2023

In the well-known investment book ‘100 Baggers: Stocks that Return 100-to-1 and How to Find Them’ by Christopher Mayer, there is a reference to none other than the TV sitcom Seinfeld. We found this intriguing so decided to dig a little further.

Way back in Seinfeld Season 1, which first aired in 1990, there is an episode called ‘The Stock Tip’. The plot summary is as follows:

- George has a friend of a friend, Mr. Wilkinson, who has made “a fortune in the stock market” and now has a “new thing” to invest in called Centrax.

- George is going to invest because it apparently sounds like a great idea and encourages both Jerry & Elaine to do so as well.

- Elaine says she doesn’t have the money to invest whilst Jerry asks some basic questions about the company for which George is very low on detail.

- Jerry eventually caves to George’s encouragement and reluctantly decides to invest as well.

- The share price of Centrax starts going south. Jerry & George obsess over the share price. Jerry becomes increasingly frustrated and dejected as it continues to fall.

- George encourages Jerry to hold the course but instead Jerry decides to sell out at a loss. George remains invested deciding he is “going down with the ship”.

- The share price of Centrax rebounds substantially and George makes a handsome profit.

One caveat that should be stated up front, whilst it is a comedy show, we pass no judgement on this or any other Seinfeld episode, which contains characters that may not always take the moral high ground. Our focus is on the fact there are some valuable investment lessons we can be reinforced from Jerry & George’s dabble into the world of the stock market.

1. Understand Your Investments

Let’s be frank, neither Jerry nor George had any idea what they were investing in. They relied upon an indirect recommendation from a friend of a friend. There was no analysis of business fundamentals, industry dynamics, or checks over management credibility conducted by either of them. They barely knew the name of the company. They were simply focused on the share price and maximising their returns in the short term based on someone else’s information and their cue to sell.

This was a textbook case of speculating rather than investing. Whilst it worked out well for George this time around, who is to say that it will happen again next time?

“There seems to be an unwritten rule on Wall Street: If you don’t understand it, then put your life savings into it.” Peter Lynch

Of course, financial losses are possible whether speculating or investing however when investing we can look to improve our chances of success by being disciplined and sticking to an investment process, as well as abiding by the rule of understanding what you are investing in. Investing is all about learning from others. The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success is in our view one of the best investment books of all time and should be a must read for any CEO. Despite these eight CEOs having very different business models in very different industries there were consistent traits that tied them together. They were all investors (not speculators) who demonstrated disciplined, rational thinking and had an astute understanding of capital/investment decisions they made. Comparing Jerry & George to these CEOs in the abovementioned book is a stark contrast.

2. Risk vs. Return

Before Jerry decides how much money he is going to spend buying Centrax shares he says to George “what if I lose it?”. Irrespective of the fact he then succumbs to George’s peer pressure, he asked a question that is important to ask ourselves every time we invest.

In our view, the upside potential of return is far outweighed by the downside risks. It would have been prudent for Jerry to not only ask that question, but then also take proactive steps to alleviate a substantial element of the risk or confirm it to be true that losing money is likely to be a very real possibility.

“High risk does not assure higher returns. It means accepting greater uncertainty with the goal of higher returns and the possibility of substantially lower (or negative) returns.” Howard Marks

The risk of permanent capital loss is something we all want to minimise and there are many ways in which this can be done. At NAOS we believe bottom-up company analysis can greatly assist with risk minimisation in conjunction with having a long-term investment horizon.

3. The Market Will Always Do It’s Thing

Jerry’s girlfriend in the episode makes an obvious yet profound comment that “markets fluctuate”. We all need to remind ourselves of this when investing that just because markets fluctuate, this does not mean it is time to sell.

In the same 100 Baggers book which referenced this Seinfeld episode, we see many examples that demonstrate the impact of market fluctuations by looking at the journeys of extremely successful companies that achieved >100x share price growth over time. Of the 365 companies in author Christopher Mayer’s study, perhaps the most pointed example is that of Apple, which between 1980-2012 had a share price increase of 225x but also saw peak to trough share price drops of 80% on more than one occasion. This is an extreme example to demonstrate a point that you can’t have the ups if you can’t navigate the downs.

There is obviously no correlation between the companies mentioned in Mayer’s study and that in which Jerry & George own shares, however it demonstrates that Jerry & George becoming fixated on constantly checking the Centrax share price does not help matters. As was the case with Apple, any number of factors may be partly responsible for the Centrax share price movement that don’t relate to this company, as is the case with any other share price.

“Price means nothing other than the equilibrium of liquidity.” John Burbank

4. Control What You Can Control

We know that we cannot control the market so we must focus on what we can control; our own emotions, our decision to buy and our decision to sell. The pitfalls of investing are well understood in theory but far harder to put into practice during times of market turbulence.

At one point Jerry says “I’m a nervous wreck, I’m not cut out for investing” and decides to sell at the very worst time. It is only with hindsight that it became known that this was the worst time to sell, however Jerry did not have control of his emotions and did not make a rational decision around selling his Centrax shares.

Equally, George goes from being extremely dejected laying down on his sofa to then smoking a cigar and recklessly spending money after his Centrax success. By the end of the episode George has moved on to the next stock opportunity with a sky-high level of confidence – a dangerous position to be in.

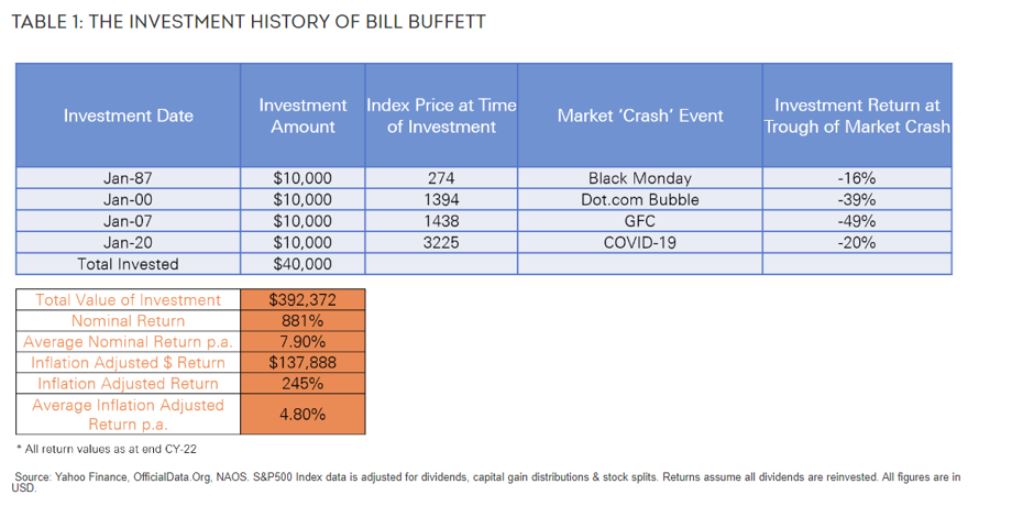

(https://blog.naos.com.au/news-media/why-timing-is-not-everything) we profile the theoretical investor Billy Buffet whom arguably had the worst possible timing for making investments of all time. He only invested four times over a 33-year period, each of which was immediately followed by a major market crash. See below table.

Despite Billy Buffet’s terrible timing he didn’t sell out, let compounding occur and made reasonable long-term risk adjusted returns. Staying emotionally steady, humble, and acknowledging that losses can and will occur are all important investment principles. Whilst Jerry & George are clearly speculators not investors, in terms of compounding capital, arguably the biggest mistake one can make is selling out at the bottom when permanent capital losses can be their most severe.

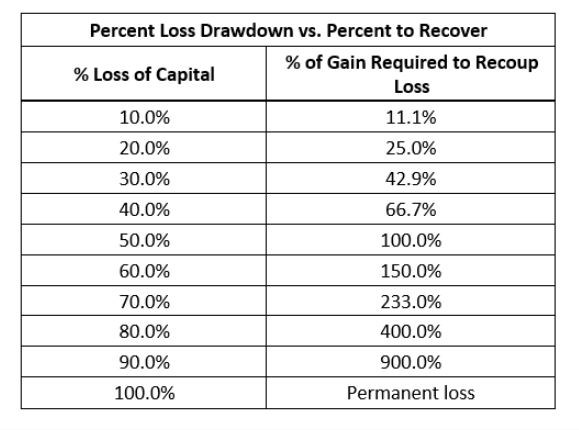

The below table highlights just how damaging selling out and crystallising a large capital loss at the bottom can be. For example, if you decide to sell once a share price is down 80%, given you are now investing off a far smaller capital base, you will need to make 400% to get back to breakeven. If, however you maintained your investment when it was down 80%, still had conviction and decided to invest more, then your percentage recovery required to recoup a loss is greatly reduced. We are not saying it is a wise investment strategy to anchor to an entry price, simply using this as a basis for stating a point.

“The investor’s chief problem, and even his worst enemy, is likely to be himself.” Benjamin Graham

At NAOS our investment philosophy is centred around three key principles: Conviction, Long-Term and Alignment. We invest in a concentrated manner with a long-term focus alongside companies with aligned management teams and directors. We believe investment lessons and the reinforcement of understood notions can be drawn from many facets of our lives. This includes learning from the mistakes of others. As investors it is important to continually learn and evolve as every day is different.

If any of the above Seinfeld episode resonates with an experience you may have had, perhaps think of Jerry & George next time you’re investing…

Join our investment community and tap into a wealth of knowledge from the NAOS investment team. Receive the NAOS Monthly Newsletter, invitations to events, and access to our shareholder education portal. Click here to subscribe.

Alternatively, if you would like to speak to a Portfolio Manager at NAOS, you can book a chat here.

Important Information: This material has been prepared by NAOS Asset Management Limited (ABN 23 107 624 126, AFSL 273529 and is provided for general information purposes only and must not be construed as investment advice. It does not take into account the investment objectives, financial situation or needs of any particular investor. Before making an investment decision, investors should consider obtaining professional investment advice that is tailored to their specific circumstances.