Simon Turner, Head of Content, InvestmentMarkets

15 April, 2024

Sustainable investment strategies such as ESG and impact investing have been through a challenging couple of years with recent performance headwinds translating into a slowdown in funds under management growth momentum.

However, rather throwing the baby out with the bathwater as some investors have, now may well be an ideal time to revisit sustainable investment strategies which are exposed to powerful structural tailwinds such as climate change.

The step back

It’s been a challenging couple of years to be an investor who cares about doing good with your money while generating solid returns.

In 2022, sustainable US equity funds underperformed the S&P 500 by 1.4% largely because energy was the best-performing sector and most sustainable investment funds were underweight.

Sustainable investors were generally accepting of the 2022 underperformance since they didn’t believe it was a longer term performance issue. After all, the oil price had been seriously impacted by the Ukraine war, a low probability scenario which appeared to be short term in nature.

However, 2023 was an even worse year for the sector with sustainable US equity funds underperforming the S&P 500 by a full 5%.

The industry’s main challenge last year was that most funds and ETFs were overweight clean tech and underweight big tech. In a year when clean tech significantly underperformed and big tech significantly outperformed, it was the perfect storm for many sustainable investment funds.

Some funds were impacted more than the headline data portrayed. For example, the Invesco WilderHill Clean Energy ETF reported a -20% return last year, a hefty 46% behind the S&P 500.

One of the criticisms the sustainable investment sector faced after such a poor 2023 was that big tech often scores well on ESG factors, so being underweight a large ESG-friendly sector which outperformed so significantly was harder to explain than being underweight oil.

The weaponization of the term ESG

For most long term investors, two years of concurrent underperformance isn’t necessarily a signal that an investment strategy isn’t working.

However, in the short-termist, trading-oriented markets which are the norm these days, two years of underperformance is enough to turn some investors off an asset class, particularly an asset class which naturally inspires heightened emotional responses due to the inherent political, moral, and ethical angles.

Case in point … Blackrock’s CEO, Larry Fink, a long term advocate for sustainable investing strategies, recently stopped using the term ‘ESG’ as he believes it has become ‘weaponized’ of late.

You’ll probably also know people who enjoying criticizing ESG, climate change, and other key sustainable investment themes. To do so has become a widespread social and political phenomenon.

However, strong social and political reactions to investment themes like this tend to move in cycles. Only a couple of years ago, most sustainable investment strategies had impressive long term track records and a generally positive market presence.

The fact that long term advocates for sustainable investing have stopped using the term ‘ESG’ may provide a clue as to how out of favour this strategy currently is. That’s potentially a buy signal for investors who are aiming to gain exposure to sustainable investment funds and ETFs at discounted underlying valuations while others are fearful.

The two steps forward

Resumed outperformance is the main step forward the market needs to see from sustainable investment funds and ETFs after the past two years of underperformance.

In the words Zhihan Ma, global head of ESG research at Bernstein: ‘Let’s not forget that ESG investing is ultimately about investing. And return is king. We hope that the recent underperformance will serve as a wake-up call for the industry to refocus resources back on leveraging ESG insights to generate returns.’

There are compelling reasons to believe that the industry’s returns are indeed on the cusp of improvement.

For starters, the availability and quality of ESG and impact data has improved in recent years, so the opportunities for the sustainable investment sector to translate the lessons learnt from recent underperformance into improved performance looking forward have never been more compelling.

For example, savvy ESG-focused sustainable investment managers are increasingly analysing high quality ESG data for quantitative clues as to which ESG factors to emphasize in their investment processes due to its innate ability to reveal management quality and risk.

In addition, the thematic drivers aligned with most sustainable investing strategies are continuing to gather pace.

Climate change remains front and centre on that front. After a string of successful COP meetings, most of the world’s carbon emissions have been committed to achieving net zero by around 2050. The scale of the required energy transition is hard for most investors to comprehend, but it’s creating strong long term tailwinds for companies involved in renewable energy, low-carbon transport, energy-efficient buildings, the electrification of industrial processes, and recycling.

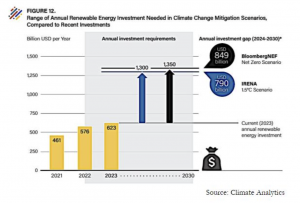

The investment required by the energy transition is enormous. As shown below, the investment flowing into renewables alone needs to triple by 2030.

This is a generational investment shift which translates into compelling investment opportunities for sustainable investment funds and ETFs.

Investors appear to concur that now is a good time to increase exposure to sustainable investment themes.

A recent Morgan Stanley survey revealed that 77% of individual global investors are interested in considering environmental and social impact when they invest, while 54% anticipate increasing their allocation to sustainable investments over the coming year.

An opportunity in the making

What a rollercoaster ride the past couple of years have been for investors in sustainable strategies such as ESG and impact investing.

However, a number of funds and ETFs in the sustainable investment space are likely to have already taken the two steps forward that were needed to ensure future outperformance at a time when investors are looking at the one step back the industry endured. In addition, the weaponization of the sector’s key terminology has made it more challenging for some investors to focus on the structural opportunities on offer.

This situation could well be the making of a compelling opportunity for longer term investors who can see through the noise.

Originally published on InvestmentMarkets