The magic of compounding!

Compound interest is a fundamental component of wealth creation and by understanding this one principle, you can make a significant difference to your financial situation over the long term.

Learn & Connect Investor Resources Important financial concepts The magic of compounding!

Compound interest means that you receive interest, not only on your initial investment, but also on the interest previously added to your investment.

- Sounds simple, but not a lot of people understand how powerful it is or how the total return grows exponentially the longer the investment is left to compound.

- Let’s take a simple example to illustrate:

- Say you had $100,000 to invest and your investment gave you a 10% annual return. You have the option to have the interest paid to you each year or re-invested.

- With the first option, at the end of 10 years, you initial investment would still be worth $100,000 and each year you would have received $10,000 in income. With the second option, the interest of $10,000 is added to the initial investment and in the second year, you earn interest on $110,000 and at the end of that year $11,000 of interest is added, and so on up to the end of the tenth year where your investment is now worth $259,374!

All you have to do is leave your investment alone and let the compounding work its magic!

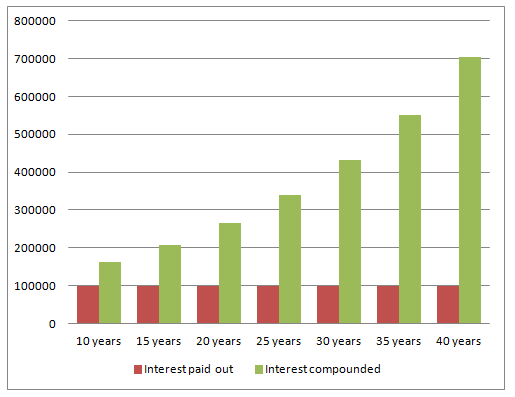

Let’s take a look at what happens if you leave compounding to work for 40 years (think of your super) you can’t touch it until you reach a certain age so it has plenty of time to compound if you start early enough. Same starting point of $100,000, but this time we’ll use a conservative 5% annual return and we’ll compare taking the interest as income each year versus letting it compound: