From the advocacy newsdesk

By Fiona Balzer, Policy and Advocacy Manager, and Damien Straker, Advocacy Coordinator

25 November 2022

AGM Season

The AGM season for the companies with June year-end draws to a close next week, with the companies with September year-end, predominantly banks, agricultural, and chemical companies, holding their AGMs in December.

Strike Count for ASA monitored companies

Company/Against vote on remuneration report

Santos 25.32%

Cleanaway 25.49%

Goodman Group 28.91%

The Star Entertainment Group 30.11%

ASX 30.52%

AGL Energy 30.69%

Newcrest 36.40%

GUD 41.10%

Blackmores 43.35%

The Star received a first strike on its remuneration report. This time last year we had reached 17 strikes, and while there remains the chance to match this, at this time it seems unlikely.

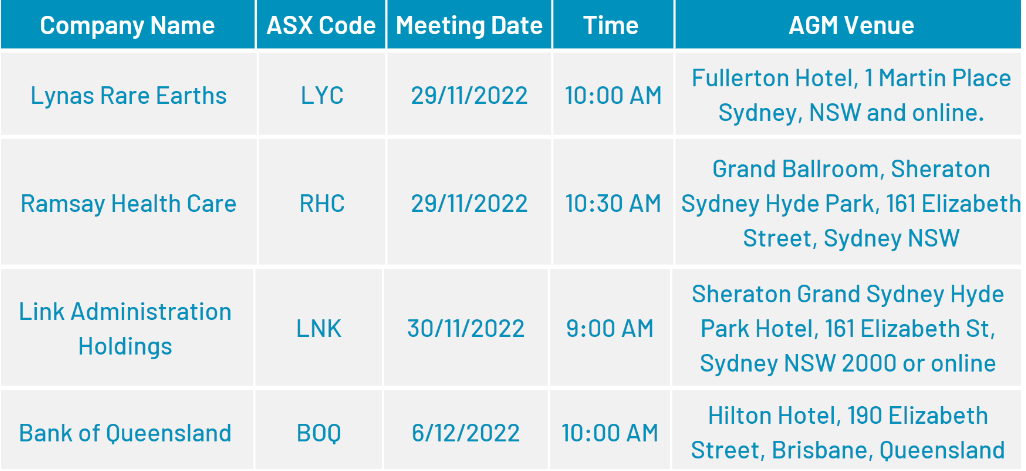

Upcoming company meetings

The full list of upcoming AGMs for the rest of the year can be viewed here. Voting intentions reports will be available approximately two weeks prior to the AGM date, except where the pre-AGM meeting with directors has been delayed.

Ramsay Health Care (RHC) AGM

We expect Ramsay Health Care’s AGM to be uncontroversial despite the financial impact of COVID in FY22 being the most severe of the pandemic due to the high incidence of cases across all regions and elective surgery restrictions in Australia. The potential takeover proposal by KKR, announced in April 2022 and terminated in September 2022, is likely to attract some questions.

The annual report describes a business continuing to assist governments across all regions through COVID-related activity, whilst upholding its values by retaining its core hospital operations and staffing levels.

Ramsay states that outlook for the group remains strong. They expect a gradual recovery in activity levels through FY23 and more normalised conditions from FY24 onwards. In its first quarter for FY23 update on 11 November 2022, Ramsay reported that trading was improving.

We will be voting in favour of all resolutions.

Read the full voting intentions report for RHC here

Link Administration Services (LNK) AGM

Over the past two years there have been expressions of interest in acquiring Link. And these, including the aborted D&D bid, have been a major distraction for the company, and have consumed a considerable amount of energy from the board and management.

The company now states it is refocused on the path forward and is considering options to build a business that will deliver value to shareholders.

Link received a remuneration first strike in FY21. While Link’s performance has been disappointing, the KMP and senior management team are relatively new and need to be motivated to deliver. Going forward if this remuneration structure is accompanied with the achievement of true stretch targets that align with shareholder outcomes the management team deserve to be rewarded. The FY22 Remuneration Report is largely in line with ASA guidelines as described in the Appendix and all undirected proxies will be voted for these resolutions.

On balance, we see there is a need for renewal of the board to restore value to shareholders. Board renewal should use an effective skills matrix that details the level of skills and experience of each director to determine gaps that require filling. Shareholders are encouraged to review the information made available by Link and to provide ASA with a directed proxy for these resolutions. To contribute to ensuring the board renewal process, all our undirected proxies will be voted against the re-election of Michael Carapiet and Anne McDonald.

Read the full voting intentions report for LNK here

Sandfire Resources (SFR) AGM

Sandfire Resource’s challenge has been the orderly wind down of a very successful Degrussa operation and at the same time rapidly developing overseas mining activities. At the time the expansionary overseas opportunities were approved, LME copper prices were on a high and demand expectations were strong. Subsequently, copper prices have fallen significantly at a time of high capex.

If that was not enough of a challenge the CEO & MD Karl Simich, who was founder of SFR with 15 years’ service, surprisingly announced, he would leave the company immediately – 30 September 2022. SFR chair announced Jason Grace would be acting CEO whilst SFR underwent a search for Mr Simich’s successor. Mr Brendan Harris has been appointed to the role where his extensive experience as an exploration geologist, highly-regarded equity analyst and senior executive with BHP and South32 will be beneficial.

A substantial proportion of the AGM Explanatory Memorandum within the notice of meeting is taken up explaining the resolutions associated with the former CEO’s termination benefits. Fortunately, the company has had a good track record from operational, financial, and safety perspectives, and has successfully managed cyclic commodity prices. Shareholders have appreciated SFR’s high level reporting.

We will be voting open proxies in favour of the resolutions.

Read the full voting intentions report for SFR here

Bank of Queensland (BOQ) AGM

The ME Bank merger has now been completed with FY22 the first full year of operations for the combined entity.

Management reports that the planned integration process is on track or ahead of the planned implementation schedule. Good synergies and cost savings have been achieved. A full detailed statement about the integration is available on page 24 of the BoQ 2022 Annual Report.

The ASA notes the progress report provided and has high expectations about further achievements that will increase operational efficiencies and contribute to financial success of the combined entity. Shareholders have been very patient as BOQ has previously reported strategies each year that have been generally ineffectual in moving the bank forward.

We voted against the Remuneration Report last year and we will do so again in 2022. There are elements we like, including the long-term nature of both the STI and LTI components. However, we are critical of the lack of quantifiable performance metrics and the lack of a financial gateway for the Performance Shares (STI) and the lack of performance metrics, which currently applies to the award of the Premium Priced Options (LTI). It relies on share price appreciation only.

Read the full voting intentions report for BOQ here

In case you missed it

Read the full voting intentions report for LYC here