By Fiona Balzer, Policy and Advocacy Manager, and Damien Straker, Advocacy Coordinator

19 August 2022

Link scheme meeting

- Retirement and Superannuation Solutions;

- Corporate Markets;

- Banking and Credit Markets; and

- Link Fund Solutions.

Link Group operates primarily in Australia and Europe and holds 42.8% of ASX listed Pexa, a digital conveyancing company.

Although there has been non-binding, indictive offers to acquire Link in the past, only the Dye and Durham Corporation (Dye and Durham) interest has proceeded to a formal offer. This is the subject of the upcoming meetings.

A Scheme Implementation Deed was amended on 21 July 2022, to reduce the Base Cash Consideration from $5.50 to $4.81 per share.

A Supplementary Explanatory Booklet dated 2 August 2022, has been distributed to shareholders, who should read it in conjunction with the original Explanatory Booklet, dated 10 May 2022, before deciding how to vote at these meetings. The Supplementary Explanatory Booklet describes the reason for the change in the Base Cash Consideration and includes a revised Independent Expert Report.

The resolutions for the meeting are commercial in nature. Shareholders who wish to appoint the Australian Shareholders’ Association as their proxy are urged to read the documentation and give a directed vote, taking into account their individual circumstances.

We encourage all shareholders to read the Scheme documentation, assess their individual situation, and give us a directed vote which reflects their situation. However, In the absence of any instruction, open or undirected proxies will be voted in favour of the resolutions.

Read more here.

ALS Limited (ALQ)

ASA will vote proxies against the re-election of Director, Siddhartha Kadia, due to perceived excess workload.

US-based Dr Kadia was appointed Director in January 2019.

He is a qualified biomedical engineer who formerly led a California based global testing laboratory and consulted for McKinsey & Co in the area of life sciences and healthcare. Dr Kadi has lived and worked in several countries, such as USA and Asia.

Dr Kadia holds directorships in five unlisted US companies that specialise in the biomedical and testing industries. More recently he has become CEO of NASDAQ listed Berkely Lights (BLI).

Since his appointment three years ago, Dr Kadia has acquired shares to the value of 64% of his base fees. ALS Limited’s stated policy is that non-executive directors must hold shares equal to at least one year’s fees (after tax) within three years of their appointment. ASA prefers directors to have invested at least one year’s worth of base fees (before tax) after three years on the board.

Although Dr Kadia clearly has both the qualifications and experience appropriate to ALS Limited, ASA does not support his re-election, because:

- we believe that he is extremely overcommitted, given not only his multiple directorships but his role as a CEO of a publicly listed company. This potentially allows him insufficient time to devote to ALS Limited, especially in the event of a crisis; and

- while it is uncertain whether Dr Kadia meets ALS Limited’s share threshold, given we are unaware of his tax situation, his investment holdings of 64% of base fees does not meet ASA’s expectations.

On this basis, we will be voting against his re-election.

Read more here.

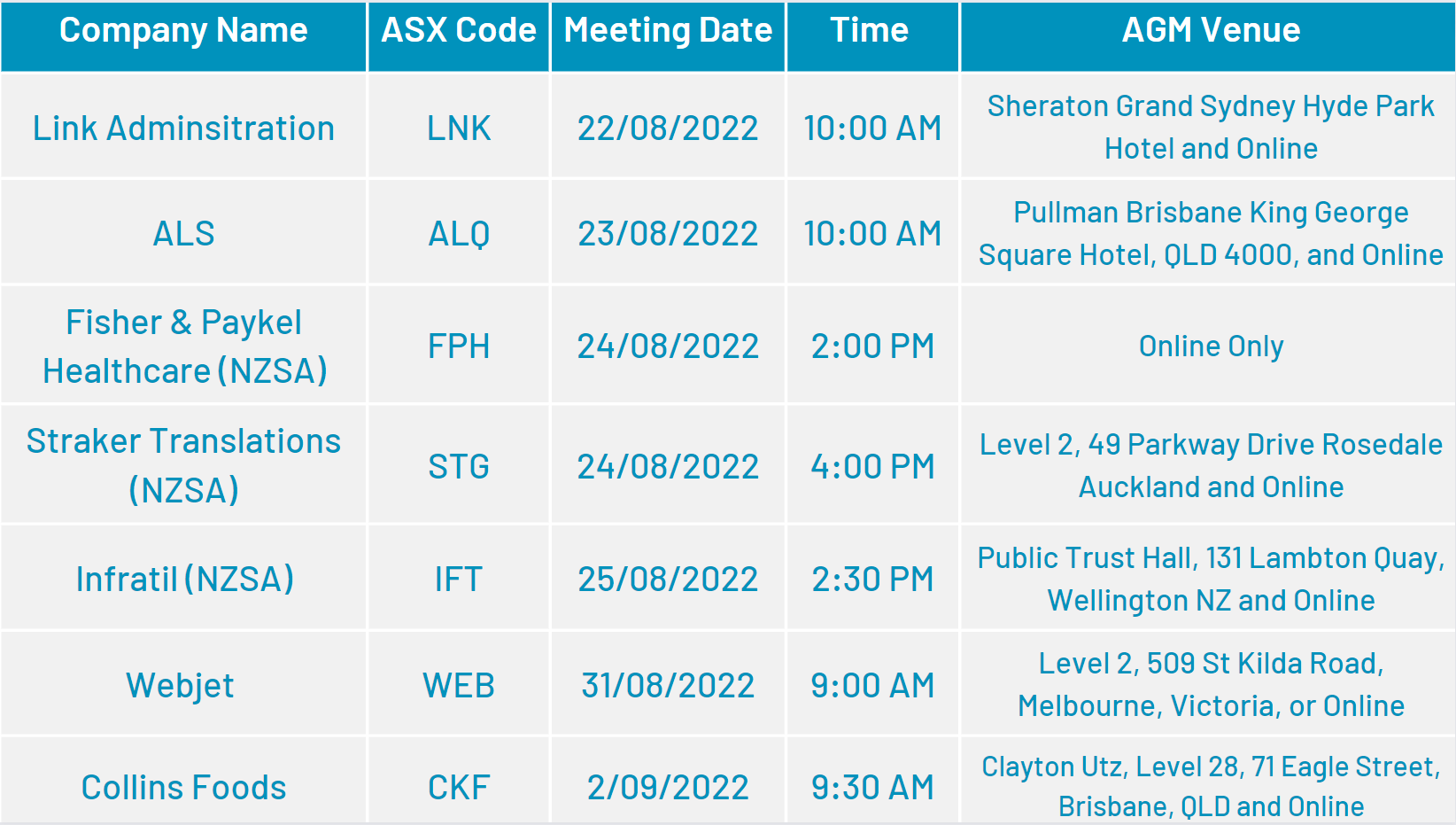

The full list of upcoming AGMs can be found here.