Simon Turner, Head of Content, InvestmentMarkets

26 April, 2024

Financial markets thrive on long term correlations holding for the simple reason it provides high-probability context for investors to make investment decisions. So when a long term correlation breaks down that most investors thought made financial and intuitive sense, it’s generally worth delving deeper.

That’s exactly what’s been happening in the bond and gold markets over the past couple of months. And it hasn’t happened in halves. For decades, gold and bonds have traded closely together almost all the time. However, gold has recently trounced bonds to an extent not witnessed since the 1970s.

This feels important and worthy of note by investors.

A long term relationship breaks down

The tight relationship between gold and bonds, both traditionally regarded as defensives, is one of those correlations that have come to be as accepted as the old furniture in the corner of investment markets. However, over the past 5 months there’s been a massive 30% divergence between gold and bonds, one of the largest divergences on record:

So what’s changed? In short, the fundamental drivers of bond and gold markets have shifted…

Bond markets pricing out interest rate cuts

Bond markets have had a lot to contend with thus far in 2024. Some would argue it has been an unprecedented period of expectation mismanagement by the Fed and other central bankers.

Only four months ago, markets were pricing in 6-8 rate cuts this year by the Fed after Powell made his now infamous inflation victory speech. How the world has changed since then.

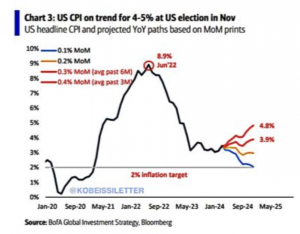

At the heart of this shift is the persistence of US/global inflation which is shaping up as a stronger adversary than the Fed assumed. As shown below, US inflation appears to have bottomed after it ran ahead of expectations in March.

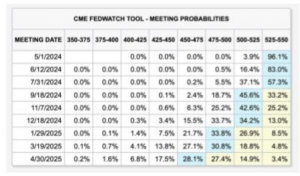

As a result of these ongoing inflationary pressures, markets are now pricing in a base case of only 2 rate cuts by the Fed this year and there’s a 13% chance of zero cuts:

In response, bond markets have priced out the 4-6 Fed rate cuts that are no longer assumed to happen this year, and bond investors are increasingly realizing that the risks may remain on the upside for rates. In fact, there’s a growing chorus of experts who are warning that the next move in the Fed Funds rate may actually be upward.

Hence, the recent underperformance of global bonds as an asset class.

The theme is the same across the board, including in Australia where interest rate expectations are now well and truly back in the ascent. The RBA now isn’t expected to cut rates until 2025.

Bond investors aren’t the only ones watching interest rates like a hawk

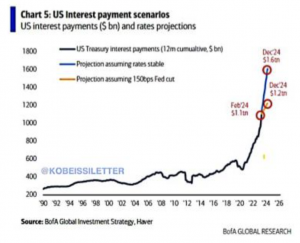

The US Government desperately need interest rates to start falling soon. As shown below, the US Treasury’s interest payments are vulnerable to what the Fed does next.

The scenario in which rates remain stable and the US Treasury’s interest bill reaches $US1.6 trillion p.a. is becoming more realistic by the day. US Federal interest currently accounts for an unsustainable 36% of tax receipts, a 27 year high, so another sharp increase in interest payments would be extremely bad news for the financial sustainability of the US Government—and the global financial system.

A few years ago, this situation would have been regarded as more likely to reside in the twilight zone than the real world … which brings us to the gold market.

Gold is ignoring the Fed

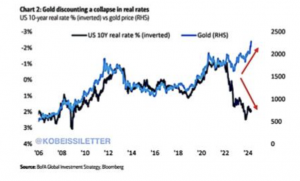

Gold is clearly dancing to a different tune to bond markets. In fact, for the first time in decades, gold investors appear to be ignoring the Fed completely:

In the past, rising interest rate expectations were bad news for bonds and gold alike. So the fact that gold is strongly outperforming during a period when US interest rate expectations have risen so dramatically is extremely unusual.

The diverse perspectives of the gold market

So what’s going on here?

This is a question which you’ll get different answers to depending whether you ask gold bugs, the general investment community, central bankers or governments.

The gold market has historically attracted investors, known as gold bugs, who believe the system is on the brink of collapse and that the best way to avoid being exposed to those systemic downsides is to buy gold.

The general investing population has often viewed gold bugs as doomsdayers who focus on gold as a means of investing far from the madding crowd, or rather, far from the madding central bankers. In the words of Adam Kobeissi: ‘Gold markets are more focused on how they can get a safe haven asset with the least exposure to central banks.’

Warren Buffet famously denounced gold as an asset class for this cynical philosophy of betting against the system. But what if these diehard gold bugs are finally correct in their prognosis for gold and the system?

There has certainly been a growing chorus of gold bugs proclaiming victory on this front in the face of perceived financial oppression, currency debasement, and financial mismanagement by governments.

However, it’s worth remembering that predicting systemic collapse is not an easy thing to do. You only get one chance every few decades or centuries to get it right. Betting on the global economy muddling through is almost always the safer, more profitable way to position your portfolio.

The broader investment community are generally ascribing recent gold market outperformance to the gold market discounting a collapse in real rates by virtue of rising inflation expectations.

This view makes intuitive sense although gold’s recent outperformance has occurred at a time when rate expectations are also rising. Consensual inflation expectations have certainly not risen (yet) to the extent that this is a credible explanation.

So we may need to look further afield than gold bugs and general investors for the more pertinent answer.

Central bankers hold the key to gold outperformance

Have you seen any central bankers with gold in their pockets recently?

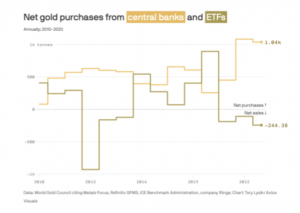

Arguably, the most rational explanation for recent gold price strength is that central bankers have been loading up on gold on an almost monthly basis over the past couple of years while ETF investors have actually been selling:

The Chinese, Indian, Turkish and Kazakhstani central banks have all been noteworthy gold buyers in recent months.

The main reason for their gold buying is generally to diversify their reserves away from their paper currencies while gaining liquidity from a ubiquitous asset without credit risk. At least, that’s the official explanation.

It’s also likely that central bankers, like gold bugs, are watching global debt levels, particularly US Government debt, with a growing awareness that it’s unlikely to be repaid unless more money is printed. That would further stoke inflation while creating an effective a race to the bottom for many leading currencies. In that context, owning gold is a compelling strategy to protect and stabilize central banks’ reserves.

These central bankers may well be onto something. If the wider investment community follow their lead, gold’s recent outperformance could be the beginning of a longer term trend.

A fundamental divergence that could be here to stay

This is an historic moment. It’s fair to say bond and gold investors are focused on very different issues at this juncture. Whether this is sustainable longer term remains to be seen.

For now, it seems that gold has well and truly asserted its strategic dominance over bonds as a defensive asset that’s well-placed to withstand inflationary pressures. If you believe inflation is here to stay, these recent trends could well be the beginning of a longer term divergence between gold and bonds which defensive investors will want to ensure they’re on the right side of.

Originally published on InvestmentMarkets